The Impact of E-Invoicing on Malaysia's Enterprises

The adoption of e-invoicing not only revolutionizes invoice application and issuance processes but also instigates a broader digital transformation by enabling data digitization. This shift introduces a range of opportunities and challenges for enterprises. In essence, it is anticipated to deeply influence how enterprises handle invoice applications, manage taxes, and undergo holistic digital transformations.

Compliance Regulations

Inland Revenue Board of Malaysia (LHDN) Electronic Invoicing Policy Overview

Transaction Type

• E-Invoice involve B2B, B2C, B2G and other transaction type

• E-Invoice are applicable to all taxpayers engaged in commercial activities in Malaysia. This includes businesses involved in providing goods and services as well as certain non-commercial transactions between individuals

Mode of E-Invoice

• Mylnvois portal website managed by LHDN

• Application Programming Interface (API)

Implementation Timeline

• 1st Phrase: 1 Aug 2024, company revenue more than RM100 million and above

• 2nd Phrase: 1 Jan 2025, company revenue more than RM25 million and up to RM100 million

• 3rd Phrase: 1 Jul 2025, all other companies

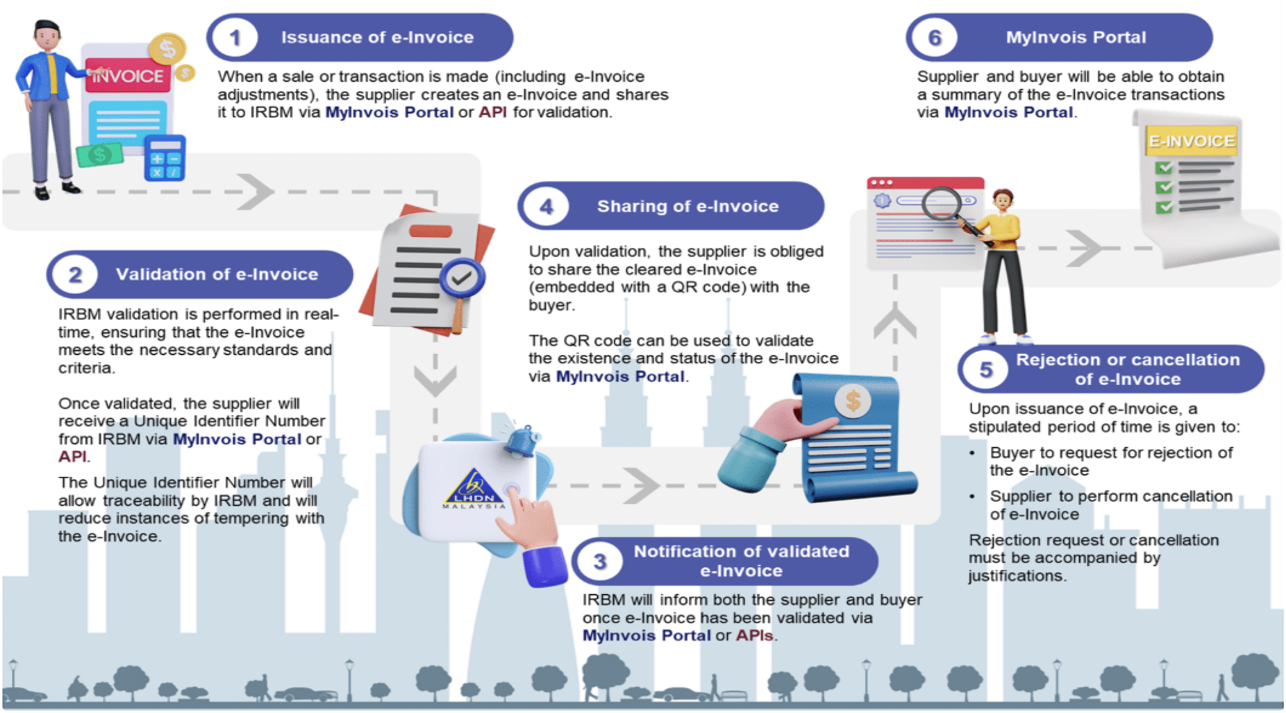

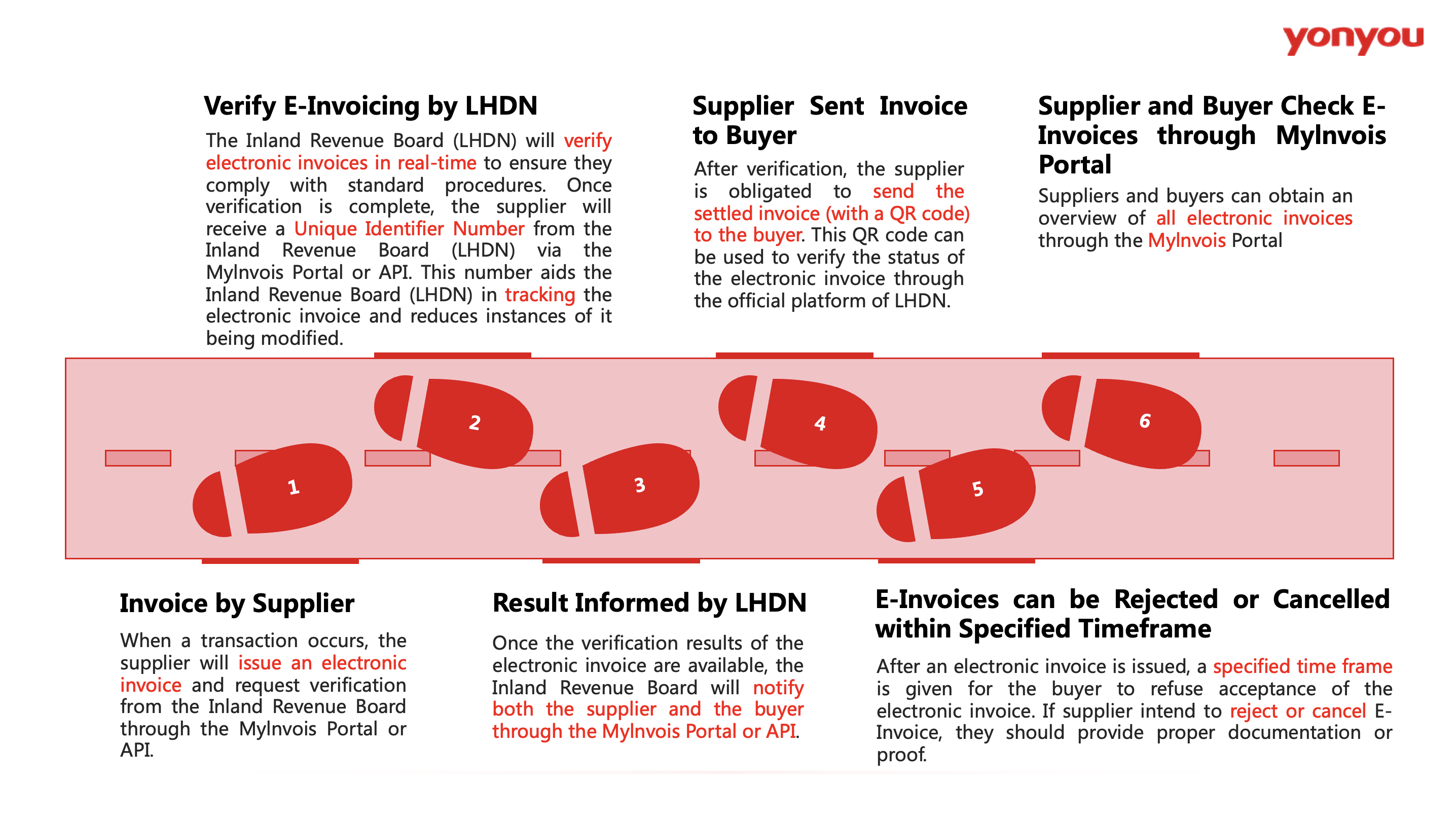

Overview of Workflow for Electronic Invoicing

Electronic Invoice Flowchart

Transforming Accounting Automation with Efficiency

The integration of e-invoicing marks a transformative leap in accounting automation, ushering in heightened efficiency and accuracy across financial processes. By automating the invoicing cycle, businesses experience streamlined operations, reduced costs, and enhanced accuracy through minimized manual errors. Real-time visibility into the invoicing process facilitates better financial management, while compliance features ensure adherence to regulatory standards. Faster payments, efficient record-keeping, and seamless integration with accounting software contribute to an overall agile and organized financial ecosystem. Moreover, the environmental sustainability aspect, with reduced paper usage, aligns with modern businesses’ commitment to eco-friendly practices. In essence, e-invoicing represents a paradigm shift, elevating traditional accounting practices towards a more efficient, accurate, and sustainable future.

Digital Intelligence Transformation

The integration of e-invoicing into business operations signifies a pivotal move towards comprehensive digital transformation. This transformative technology streamlines and modernizes the entire invoicing process, bringing efficiency and agility to the forefront. By seamlessly incorporating e-invoicing, businesses not only enhance operational speed and accuracy but also pave the way for improved financial management. The shift towards a paperless and automated invoicing system not only reduces costs associated with traditional methods but also aligns with the broader strategy of embracing digitization. This marks a strategic leap towards a more agile, cost-effective, and digitally-driven business environment, positioning organizations for sustained success in the digital era.

Transition of E-Invoice Adoption

The process of fully adopting electronic invoicing presents its unique set of challenges for businesses. While the benefits are substantial, organizations encounter hurdles such as navigating complex technological transitions, ensuring data security, and addressing potential resistance to change among stakeholders. Integration with existing systems and the need for comprehensive training further contribute to the complexity. Despite these challenges, businesses embracing full e-invoice adoption demonstrate resilience and a commitment to modernizing their financial processes. Effectively addressing these hurdles is crucial for reaping the rewards of enhanced efficiency, reduced costs, and streamlined operations associated with electronic invoicing.

Digital Transformation Goes Beyond Operational Efficiency

Embarking on a digital transformation, e-invoicing surpasses mere operational efficiency, influencing diverse aspects of business dynamics, from heightened accuracy to real-time financial insights. This evolution reshapes transactional norms, boosting precision and speed in financial processes. Integrating e-invoicing empowers organizations with immediate financial transparency, aiding superior decision-making. Its impact extends beyond operational gains, fostering a progressive and tech-savvy business milieu. E-invoicing isn’t just about efficiency; it’s a strategic thrust propelling businesses towards a digitally innovative future and optimized financial processes.

Introduction to the Advantages of Yonyou Electronic Invoice

Yonyou Electronic Invoice Service Platform is a cloud-based electronic invoice platform. It addresses challenges such as high costs associated with invoice usage in business transactions. This platform achieves a comprehensive networked and electronic invoicing system, enabling a closed-loop management of the entire invoicing process.

The electronic invoice service seamlessly integrates with enterprise ERP systems, facilitating an integrated process of invoicing, circulation, receipt, reimbursement, recording, and archiving. This integration reduces operational costs and enhances operational efficiency for businesses.

For individual users, the platform allows for the collection and management of invoices. Through mobile applications, it simplifies the otherwise complex invoice processing and reimbursement procedures, providing a convenient user experience.

The Advantages of Yonyou Electronic Invoice:

| Convenience and Efficiency: Yonyou Electronic Invoice fully digitizes the entire process, eliminating traditional paper invoices and simplifying issuance, transmission, storage, and management. Through digitization, invoices can be quickly and accurately generated, sent, and received, saving time and labour costs.

| Time and Effort Savings: Yonyou Electronic Invoice supports automated and intelligent invoice management, significantly reducing manual operations and error rates. No manual data entry or verification is required as the system automatically identifies and matches invoice data, enabling one-click generation, entry, and verification operations and greatly enhancing financial processing efficiency.

| Precision and Accuracy: Yonyou Electronic Invoice employs advanced OCR (Optical Character Recognition) technology and data validation mechanisms to ensure accurate invoices. Additionally, digital invoice information and data are stored in the cloud, enabling anytime querying and review, effectively avoiding risks of lost, copied, or tampered invoices.

| Financial Compliance: Yonyou Electronic Invoice complies with relevant national laws and regulations as well as financial compliance requirements, ensuring the financial processing of companies is compliant. Electronic invoices hold the same legal validity as paper invoices and serve as legitimate and effective financial vouchers, mitigating risks and disputes arising from invoice issues.

| Environmentally Friendly: The use of Yonyou Electronic Invoice reduces the need for printing, transmission, and storage of paper invoices, significantly lowering paper consumption and environmental impact. This is meaningful for companies to fulfill their social responsibilities and promote green development.

In conclusion, the Yonyou Electronic Invoice service platform provides enterprises and individuals with a solution that is convenient, efficient, time-saving, accurate, compliant, and environmentally friendly. Its benefits are rooted in digital processing, automated management, and more. It addresses the issue of high traditional invoice costs, achieving closed-loop management of invoice information and lowering operational costs while enhancing efficiency. For individual users, the platform simplifies invoice processing and reimbursement procedures, offering a convenient application experience.